Have a lawsuit and waiting to settle?

We provide fast cash settlements. Apply for funding in less than 2 minutes!

Waiting for a legal verdict or settlement can be stressful, especially when you have day-to-day expenses to pay. However, with pre-settlement funding, you can obtain compensation before your case is resolved in as quickly as a few days—without a complicated application process.

We consult your attorney and review your application.

If approved, we send you funds via wire transfer, as little as 24 hours.

Cover costs, gain peace of mind and concentrate on recovery.

Pre-settlement lawsuit funding is a valuable resource for plaintiffs waiting for a verdict or settlement. Legal proceedings can be long and drawn-out. It can take months or even years for a plaintiff to receive compensation. A lawsuit advance gives you some breathing room to negotiate a higher settlement, so you don’t feel the urgency to settle quickly just to keep up with the bills.

Mustang Litigation Funding works with plaintiffs, attorneys, and investors to provide peace of mind and financial stability throughout the legal process. Learn more about the ins and outs of pre-settlement funding to determine if a lawsuit advance makes sense for you and your pending claim.

No, pre-settlement funding is not a loan. While we occasionally use the term “lawsuit loan”—since it’s a common search phrase—what we offer is technically different.

Pre-settlement funding is a non-recourse cash advance provided in exchange for a portion of your potential future settlement. Unlike a traditional loan, you are not required to repay the advance if you lose your case. In essence, we assume the risk. You receive funds upfront, and if your case is successful, we collect an agreed-upon share of your settlement.

The ability to access cash quickly is good news for plaintiffs who feel pressured to settle their case quickly for bills and other expenses. A rushed settlement often means less compensation than what you might have received if you gave your case more time to settle the right way.

There are typically no restrictions on what you do with pre-settlement litigation compensation. Many of our clients use this funding to cover rent or mortgage costs, medical bills, and other daily living expenses.

Unlike traditional loans, a lawsuit advance is non-recourse, meaning you do not have to pay it back if you lose your case. You are only required to repay litigation financing if you win your case or reach a favorable settlement out of court.

Customer service at its best, treated me with respect. Looking forward to being a happy customer!

Fast, quick, and easy, best way to go any day. Thank you for your rapid service.

Mustang Litigation Funding is 2ND TO NONE! We go nowhere else for our clients!

Pre-settlement funding differs from personal loans in another important way. The approval process with a non-recourse lawsuit advance is simpler and faster. In fact, it can take as little as 24 hours for a qualified applicant to get legal pre-settlement funding.

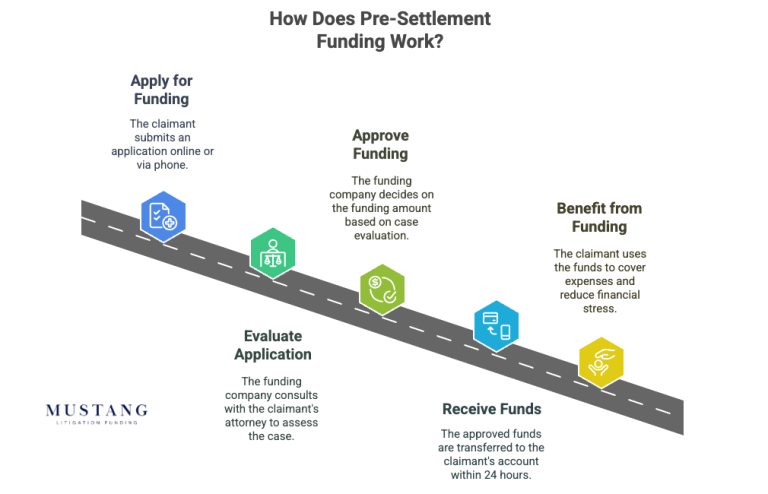

Here is basic workflow of a pre-settlement loan and overview of the funding timeline:

Legal financing starts with a lawsuit. Once you have hired an attorney and they file a claim on your behalf in state of federal court, you can start the process. While you don’t need your attorney’s consent to apply for funding, you cannot obtain a lawsuit advance without notifying them.

The application process is simple and straightforward. Complete and submit a no-risk online application with Mustang Litigation Funding. There is no credit check for this type of legal financing. Instead, we contact your attorney to learn more about your case so we can prepare a proposal based on the likelihood of a good outcome.

If approved, we send you and your attorney documentation outlining the terms of your pre-settlement lawsuit advance. We encourage you to review this information carefully to ensure you’re fully aware of your rights and responsibilities when you accept pre-settlement funding.

At Mustang Litigation Funding, we believe transparency is essential for building trust and loyalty with individuals, investment groups, and legal firms. Because we approve clients we believe have a strong chance of winning their claim, we don’t have to charge exorbitant rates and excessive fees.

If your case qualifies and you agree to the pre-settlement funding terms, we will transfer your money in as little as one day from the time you sign your agreement. You can use this money for things like medical bills, rent, mortgage payments, and other living expenses.

We offer litigation settlements for a broad variety of cases, offering you the

capital and flexibility you need.

Pre-settlement funding is available to plaintiffs in most states, including California, Florida, New York, Texas, Georgia, Michigan, Missouri, and Alabama.

There are several benefits to pre-settlement funding for individuals awaiting the outcome of legal proceedings.

Pre-settlement lawsuit funding:

Keep in mind, while pre-settlement funding is becoming more widely available, some states prohibit lawsuit advances at this time. Check with your attorney or apply online and a representative with Mustang Litigation Funding will get back to you to discuss your options.

Now, let’s review the basics about pre-settlement funding, and answer some other questions you might have.

No. Sure, sometimes pre-settlement funding is referred to as a pre–settlement loan. However, you are not borrowing money from our firm or anyone else for that matter. You receive a payout in advance for a future court award or settlement for a pending case. If you do not win your case, you do not repay these funds.

Our rates vary from case to case. The terms of your litigation financing depend on the facts and strength of your lawsuit.

Pre-settlement funding has no effect on your credit score. We don’t pull your credit score and a lawsuit advance does not create debt and won’t show up on your credit report.

Yes. We handle your personal information and the details of your legal proceedings with the utmost discretion. Since our founding, we have funded more than $120 million and issued funds to more than 10,000 individuals and firms. This extensive portfolio would never be possible if we weren’t trustworthy and professional.

Complex, high-stakes legal cases can take a long time to resolve. If you need additional funds, you can apply for another round of pre-settlement legal financing. We review applications on a case-by-case basis.

If your case settles for less than expected, you are not responsible for covering that gap. We consider this risk when reviewing your application and offering you a lawsuit advance.

Yes. Like a court award or settlement, pre-settlement funding typically comes with no restrictions. Use it as needed.

Yes, pre-settlement funding can be worth it, especially if you’re facing financial struggles during a legal case. It offers immediate relief, allowing you to manage essential expenses like legal fees and rent while you wait for your case to conclude. This financial support acts as a lifeline, ensuring you can navigate through the challenges of the legal process without added stress about money.

Ultimately, pre-settlement funding is a personal choice. And there are other options to help you cover your expenses including credit cards and personal loans. We encourage plaintiffs to consider their personal financial situation, the length of legal proceedings, and if there’s a need for immediate funds when making this decision.

As a leading lawsuit lender, Mustang Litigation Lending is committed to helping individuals, groups, and legal firms make safe and informed choices. We are here to answer questions and guide you through the lending process every step of the way. Call or connect online to learn more.

To learn more about attorney and law firm funding and its benefits for your practice, contact Mustang Funding today. Our team of experts has a combined 100+ years of experience in the finance industry and 50+ years in litigation finance.

Mustang Litigation Funding works with capital partners and affiliated entities to provide a non-recourse cash advance to an individual. All non-recourse cash advances are subject to review and approval. Not all cases or requests will qualify. Certain states regulate non-recourse cash advances and may disqualify an applicant from receiving a non-recourse cash advance from Mustang Litigation Funding or its partners/affiliates.

This web site is for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or investment advice. You should consult your own tax, legal, investment advisors before engaging in any transaction.