It can take a long time to receive a settlement check no matter how strong your claim. In the meantime, you may need financial support to help you manage bills and other finances. That is where Washington pre-settlement funding can help.

While pre-settlement funding is sometimes referred to as a lawsuit loan, this is an inaccurate and misleading term. Unlike a loan, there is no income or employment verification or credit check with pre-settlement funding. Instead, pre-settlement funding in Washington is like a cash advance.

With pre-settlement lawsuit funding, you can pay your outstanding bills and not have to settle for a lower amount than you deserve. The funds are repaid when you receive a settlement or jury award.

Is Pre-Settlement Funding Considered a Loan?

No, pre-settlement funding is not a loan. While we occasionally use the term “lawsuit loan”—since it’s a common search phrase—what we offer is technically different.

Pre-settlement funding is a non-recourse cash advance provided in exchange for a portion of your potential future settlement. Unlike a traditional loan, you are not required to repay the advance if you lose your case. In essence, we assume the risk. You receive funds upfront, and if your case is successful, we collect an agreed-upon share of your settlement.

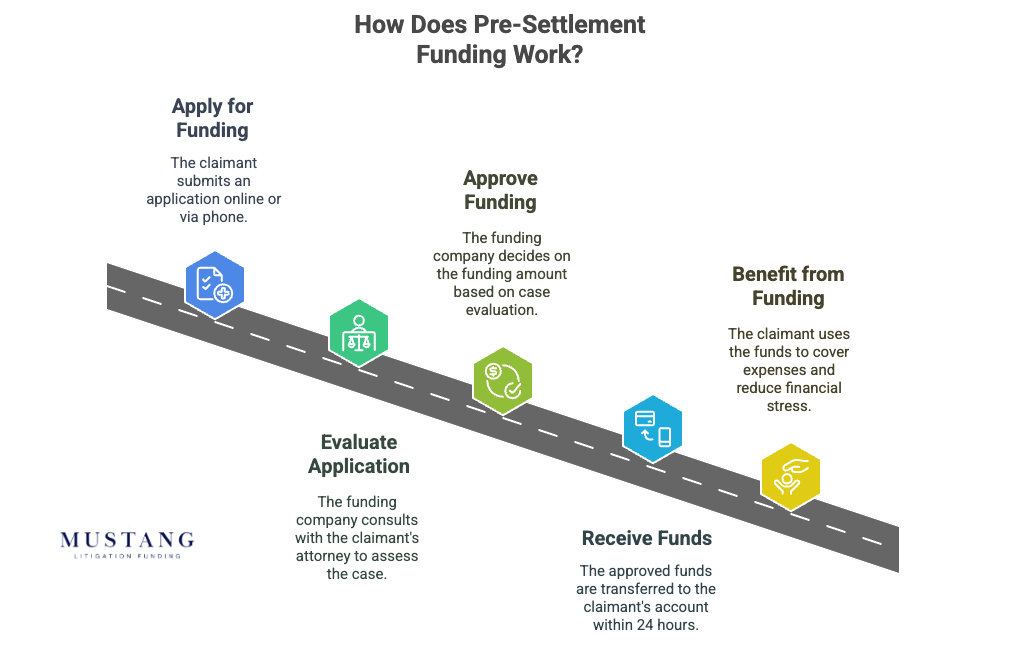

How Pre-Settlement Funding in Washington Works

To qualify for pre-settlement funding in Washington, you must be at least 18, have a current personal injury lawsuit pending and be represented by an attorney. Your attorney must be willing to provide details to the funding company about the strengths of your case. It’s easy to get started, you can begin today by filling out a 2-minute online application on our website.

After a careful evaluation of your case, the lending company decides whether you qualify for pre-settlement funding. If you qualify, you can expect to receive your funding fast, usually within 24 hours.

Washington Pre-Settlement Funding Laws

In Washington, the statute of limitations for filing a personal injury lawsuit is three years from the accident date. Failing to file a personal injury lawsuit by that deadline means your case cannot move forward.

Unlike the majority of U.S. states, Washington uses a pure comparative negligence standard when it comes to liability. That means that even if you were mostly at fault for the accident, you can still receive compensation. That compensation is lowered by your percentage of fault as decided by a jury. For instance, if you were deemed 30 percent at fault, a $100,000 settlement is reduced to $70,000.

Pre-settlement loans in Washington are non-recourse. If it turns out that you don’t receive a settlement or the jury declines to award damages, you do not have to pay back the pre-settlement funding. The lender takes all the risks, which is why each claim is reviewed so thoroughly.

While most people use pre-settlement funding to pay bills and take care of regular needs, there are no restrictions on how you can use pre-settlement funding in Washington.

Personal Injury and Other Pre-Settlement Funding in Washington

Personal injury lawsuits run the gamut from motor vehicle accidents to premises liability to defective products. In addition to personal injury lawsuits, pre-settlement funding in Washington is also available for workers’ compensation claims.

Get the Funding You Need. Contact Us Today.

To learn more about pre-settlement lawsuit funding in Washington and whether your case qualifies, contact Mustang Funding today. We serve Seattle Spokane, Tacoma, Vancouver, Bellevue, and other areas of the state. Since 2018, we have provided more than $150 million in funds to plaintiffs and attorneys.