Life has been tough ever since your accident. You cannot work, and your medical bills are piling up. You worry about having enough money to pay your rent or mortgage and keep food on the table. Because another party caused your injury and you have filed a personal injury lawsuit, you know you should receive a settlement, but that can take months or even years. How are you going to keep your head above water until then?

The answer lies in Texas pre-settlement funding. Although pre-settlement funding is sometimes described as a lawsuit loan, that is not accurate. It is actually a cash advance against your settlement, which serves as collateral.

There is no credit check, and pre-settlement funding does not affect your credit score.

Applicants usually receive up to 20 percent of their anticipated settlement amount. You are free to use this money in any way you want.

Insurance companies like to drag out settlements for as long as possible, hoping to wear down accident victims so they will accept a lower offer. Pre-settlement funding in Texas gives you breathing room while you wait to receive the compensation you deserve for your injuries.

Is Pre-Settlement Funding Considered a Loan?

No, pre-settlement funding is not a loan. While we occasionally use the term “lawsuit loan”—since it’s a common search phrase—what we offer is technically different.

Pre-settlement funding is a non-recourse cash advance provided in exchange for a portion of your potential future settlement. Unlike a traditional loan, you are not required to repay the advance if you lose your case. In essence, we assume the risk. You receive funds upfront, and if your case is successful, we collect an agreed-upon share of your settlement.

How Pre-Settlement Funding Works in Texas

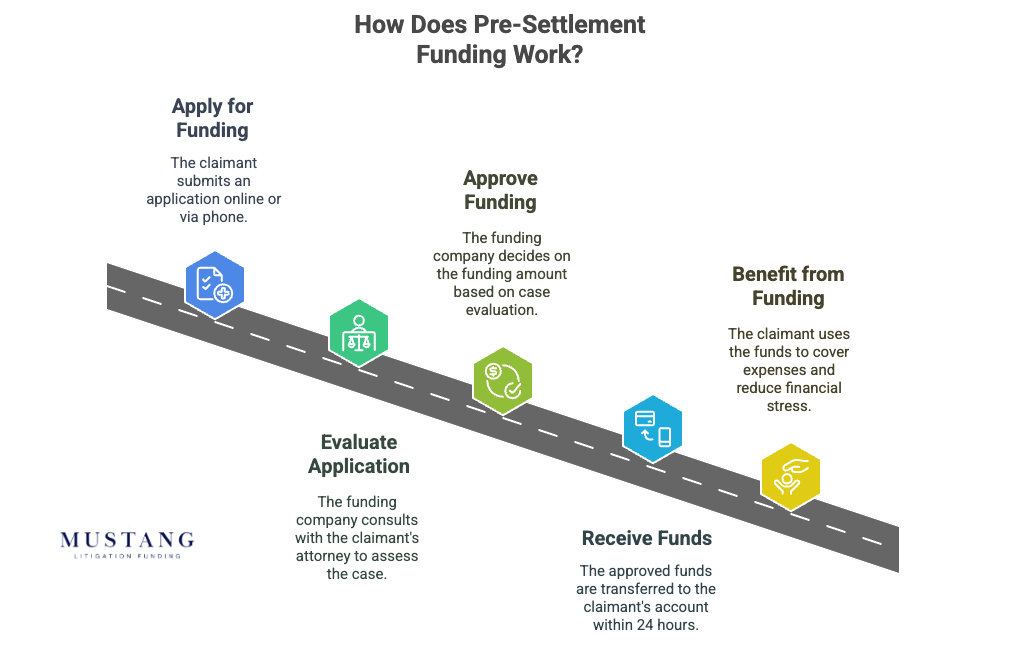

In Texas, you can apply for lawsuit funding at any time during your case. You must be engaged in a current personal injury lawsuit filed in civil court. Your attorney must agree to work with us for eligibility. Lenders must know the strength of your case before pre-settlement funding is approved.

In Texas, pre-settlement funding is also known as lawsuit loans. It involves receiving an advance against your future settlement. The lender assumes this risk if your claim fails or a jury rules against you; you are not obligated to repay the loan.

Once your claim is settled or your lawsuit is won, you pay back the lender.

Texas Pre-Settlement Funding Laws

In Texas, the statute of limitations for filing a personal injury lawsuit is generally two years from the date of the accident. Failing to file your lawsuit by this deadline means your lawsuit cannot go forward.

However, if the accident occurred on public property or any type of government entity is involved, you must file a claim within six months.

When it comes to liability, Texas is a modified comparative negligence state. As long as a plaintiff is less than 50 percent at fault for the accident, they can sue for damages. They cannot receive compensation if they are more than 50 percent responsible.

Award amounts are reduced by the percentage of the plaintiff’s liability. For instance, if a jury determines you were 25 percent at fault for the accident causing your injuries, a $100,000 award is reduced to $75,000.

Eligibility Criteria for Pre-Settlement Funding in Texas

The eligibility criteria for pre-settlement funding in Texas are straightforward. You must be represented by an attorney and engaged in an ongoing lawsuit, including premises liability or product liability, motor vehicle accidents, or medical malpractice.

However, not all pre-settlement funding concerns personal injury lawsuits. In some situations, a plaintiff with a pending wrongful termination case filed may also qualify for pre-settlement funding. Mustang Funding also offers pre-settlement funding for those with a pending sexual abuse lawsuit.

Your lawyer plays a critical role in the funding evaluation process. We must consult with them to determine whether you have a strong case and are likely to obtain a substantial settlement or a favorable verdict if heading to trial. In your application, always provide adequate contact information for the attorney or law firm handling your case.

How Do I Apply?

The application process for pre-settlement funding can take less than two minutes. The application is free, and there are no hidden fees or charges. Fill out this form below to get started.

After applying, our internal team evaluates the strength of your claim and determines an appropriate monetary figure. After consulting with your attorney, we will base our final decision on whether we believe you will win compensation and how much you are likely to receive.

If you have provided complete contact information for your attorney, we could have an answer for you in as little as 24 hours.

When you receive your proposal, review the details with your attorney. They are intimately familiar with the details and value of your case, so they are best equipped to provide counsel as to whether you should accept the funds and how much to accept. If you accept the proposal, funds will be dispersed via check or direct transfer.

Pre-settlement Funding FAQs

How Much Does Pre-Settlement Funding Cost?

We offer industry-competitive rates for every six months your case is outstanding. Your exact rate, though, will depend on a number of factors related to the specifics of your case. If you’re approved for funding with us, we’ll send an agreement detailing the terms of funding.

Can My Lawyer Deny Me from Pre-Settlement Funding?

In most jurisdictions, a lawyer does not have the authority to unilaterally deny you from seeking pre-settlement funding; the decision to obtain such funding is yours to make. It should be noted that we need the cooperation of your attorney to proceed with the funding application.

How Often Can I Apply?

You can get additional pre-settlement funding as long as your case supports it. However, final approval may vary depending on a number of factors, including case type and expected duration of case.

Have more questions before you apply? Just call (877) 610-0950. Our team looks forward to helping you

Learn More About Pre-Settlement Funding in Texas

If you would like to know more about litigation financing in Texas and how it can help you, contact Mustang Funding today. If approved, you may receive your funding in as little as 24 hours.

Our services are available throughout the state, including Austin, Dallas-Fort Worth, El Paso, Houston, and San Antonio, and extend to other states where litigation funding is offered.