Because of another party’s negligence, recklessness, or deliberate action, you are seriously injured and trying to recuperate from this life-changing situation. Meanwhile, you suffer financially as well as physically from the aftermath of the accident. Medical bills keep coming in, and paying for necessities becomes more difficult. If you have a personal injury lawsuit filed against the at-fault party, Georgia pre-settlement funding can help you get back on your feet financially.

Is Pre-Settlement Funding Considered a Loan?

No, pre-settlement funding is not a loan. While we occasionally use the term “lawsuit loan”—since it’s a common search phrase—what we offer is technically different.

Pre-settlement funding is a non-recourse cash advance provided in exchange for a portion of your potential future settlement. Unlike a traditional loan, you are not required to repay the advance if you lose your case. In essence, we assume the risk. You receive funds upfront, and if your case is successful, we collect an agreed-upon share of your settlement.

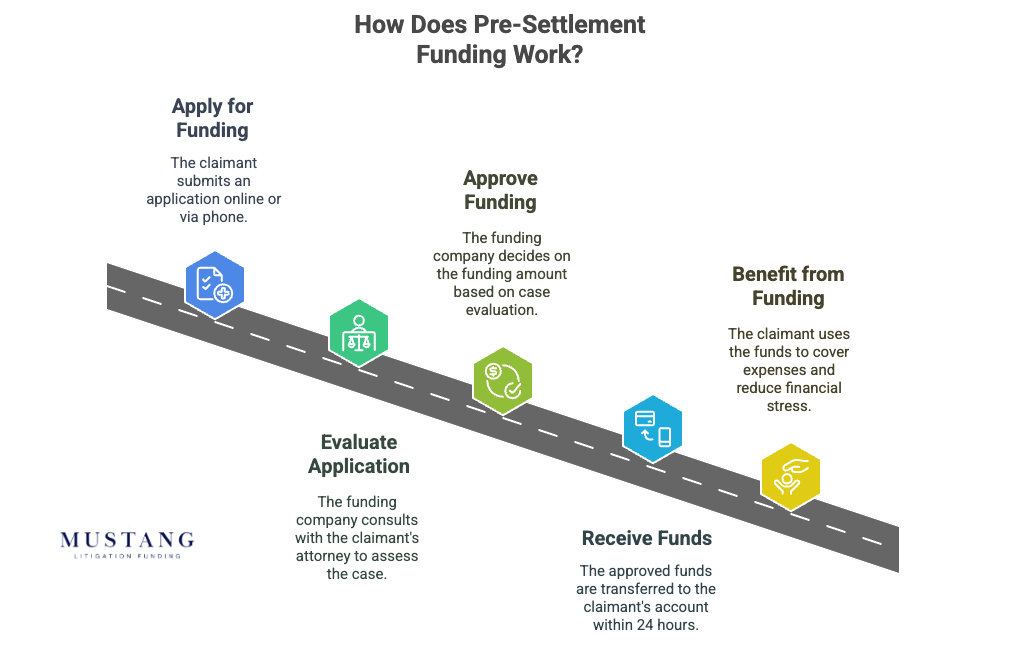

How Pre-Settlement Funding Works in Georgia

In any civil court case, there is always the risk that the insurance company will not agree to a reasonable settlement or that a judge or jury renders an unfavorable verdict. Lawsuit financing options in Georgia is non-recourse. That means that even if you do not receive compensation for your case, you do not have to pay back the pre-settlement funding amount. It is a risk taken on by the lender, and it is a great advantage for the client.

Georgia Pre-Settlement Funding Laws

Georgia operates under a modified comparative negligence standard. If a jury determines that you were more than 50 percent at fault for your accident, you cannot collect damages. However, you can collect damages even if you were partly at fault, as long as the percentage of fault does not exceed 49 percent.

Your award is reduced by the percentage of fault for which you are deemed responsible. For instance, if the jury decides you are 20 percent at fault, a $100,000 award is reduced to $80,000.

Under Georgia law, you may qualify for pre-settlement funding if you meet the following criteria:

- You must have a pending personal injury case filed in civil court.

- Your case cannot have liens from another lender.

Personal Injury Pre-Settlement Funding in Georgia

Your attorney must agree to work with us in order for you to qualify for personal injury pre-settlement funding in Atlanta, Savannah, or anywhere in Georgia.

We will discuss the strength of your case with your lawyer prior to making a decision regarding your pre-settlement funding. Your case must have a strong potential for achieving a good settlement or verdict amount.

In Georgia, the statute of limitations for filing a personal injury lawsuit is generally two years from the date of the accident. Failing to file your lawsuit by that deadline means your claim likely cannot go forward.

Pre-settlement funding does not affect your credit score. No credit checks are run.

Eligibility Criteria for Pre-Settlement Funding in Georgia

Mustang Funding provides legal funding for active personal injury claims to plaintiffs from all types of personal injury cases, including medical malpractice, civil sexual assault and battery, car accidents, employment discrimination, product liability, a PG&E wildfire claim, and more. As noted, pre-settlement funding is a cash advance available to plaintiffs represented by counsel based on the potential value of your lawsuit.

What Are the Benefits of Pre-Settlement Funding in Georgia?

Mustang’s pioneering spirit and commitment to innovation make us a trailblazer in the legal asset industry, offering a unique blend of experience, vision, and inclusivity to our valued clients. With pre-settlement funding, you can obtain compensation before your case is resolved in as quickly as a few days—without a complicated application process.

Accessing cash quickly is good news for plaintiffs who feel pressured to settle their cases for bills and other expenses. A rushed settlement often means less compensation than you might have received if you gave your case more time to settle the right way.

Broadly speaking, it also helps level the economic playing field against deep-pocketed defendants and insurance companies. With adequate resources, both the plaintiff and their attorney are better equipped to pursue a claim to its full potential.

Other benefits include:

- Does not require an employment check: We approve applications solely based on the strength of your legal claim, not your job history.

- Typically has no restrictions on how you use it: From coverage of legal expenses to food, utilities, and other day-to-day bills, use pre-settlement funding as you see fit.

- Does not require monthly payments: Unlike credit cards and personal loans, litigation advances do not have monthly payments. Instead, these funds are only repaid once your case is completed.

Finally, if your case settles for less than expected, you are not responsible for covering that gap. We consider this risk when reviewing your application and offering you a lawsuit advance.

What About Other Funding Options?

Credit cards, personal loans, and even help from family members may help keep you financially afloat during your pending lawsuit, but these options have drawbacks.

Personal loans and help from family members must be paid back, even if your case doesn’t end in your favor. Losing a case and paying back a loan would be financially devastating for plaintiffs. Remember, pre-settlement funding is non-recourse.

Relying on credit cards can be problematic because they often carry high annual percentage rates (APRs), which can quickly increase the amount owed if balances are not paid off in full. Over time, this can lead to substantial interest costs, making it difficult to manage debt.

Cashing out a retirement account may seem lucrative in the short term. However, cashing out a 401(k) or an IRA account early will result in a large tax bill and early withdrawal penalties.

Ultimately, pre-settlement funding is a personal choice. We encourage plaintiffs to consider their personal financial situation, the length of legal proceedings, and whether immediate funds are needed when making this decision.

Learn More About Lawsuit Loans in Georgia

If you would like to know more about how funding for pending lawsuit can help you in Macon, Athens, and throughout Georgia, and other states where pre-settlement funding is lawful, contact Mustang Funding today. If approved, you may receive your funding in as little as 24 hours.